In India, working overtime is a common corporate practice. Employees across different industries frequently devote additional hours at work.

A recent International Labour Organization survey found that the average Indian worker aged 15 and above works 47.7 hours per week —well above the standard 40-hour workweek.

Now, for those extra 7.7 hours, employers are required to follow the overtime calculation formula and compensate employees accordingly. However, due to unclear overtime rules, many of them make errors in calculating and paying the same.

So, in today’s blog, we’ll explore overtime pay and learn how to calculate it accurately, avoiding common mistakes. Let’s start!

What Is Overtime Pay?

Overtime pay refers to the compensation an employee receives for working beyond their regular hours.

For example, suppose an individual’s standard shift is from 9 am to 5 pm but they continue working until 7 pm. In that case, the additional two hours are considered overtime and are compensated at a different rate than regular hours. This rate is typically higher, as mandated by labor laws.

The maximum overtime hours allowed in India is between 1 to 3 hours a day.

Why is Accurate Overtime Pay Calculation Important?

There are many reasons why employers should be accurate while calculating overtime pay:

Boosts Employee Satisfaction

Employees feel dissatisfied at work if they are not remunerated properly—especially when working extra. However, accurate overtime compensation prevents that. By compensating an employee fairly for their hard work, it ensures they feel motivated and boosts their satisfaction.

Encourages Employee Retention

According to statistics, 28% of workers consider quitting their jobs due to unfair pay. To avoid this, employers must pay overtime fairly. If employees feel rightly compensated for their efforts, they are less likely to switch jobs.

Maintains Fairness

Another vital reason why accurate overtime pay calculation is important is because it fosters transparency in the organization. If all employees who work overtime are paid their bonuses fairly and equitably, it creates a positive work environment.

Prevents Legal Repercussions

The overtime laws in India have set a list of rules and guidelines for overtime pay calculation. If an employer fails to adhere to them, it can cause severe legal troubles.

Understanding Overtime Pay Laws in India

Despite seeming vague, the overtime rules in India are actually quite simple to understand and implement. Let us break it down for you.

First things first, there are two main laws governing overtime pay calculation in India:

- The Minimum Wages Act, 1948: This law aims to safeguard workers from being exploited. It states that if a worker works overtime, they should be entitled to overtime pay for every extra hour worked. It should be double their regular wage.

- The Factories Act, 1948: Under this law, if a worker works beyond 9 hours a day or 48 hours a week, it is considered overtime. To compensate for the same, employers must pay them twice the regular hourly wage.

But that’s not all. Apart from these two laws, the Shops and Establishment Act (SEA) also comes into play to determine an employee’s overtime pay.

The SEA is a state-specific law that defines the rules for overtime pay eligibility and the rate at which the employees in that particular state will be compensated for working overtime. However, this law is only applicable to certain types of industries, like, retail, food, entertainment, service, and IT.

What Are the General Methods for Overtime Calculation in India?

In India, there are two prominent overtime pay calculation methods—one for salaried employees and the other for hourly wage workers. Let’s discuss both of them in detail.

1. Salaried Employees

According to the overtime policy in India, the Overtime (OT) for a salaried employee is calculated on the basis of their Basic Salary and Dearness Allowance (DA). It may or may not include other allowances. Therefore:

OT = 2 x [Basic Salary + DA + any other allowance / (Total number of working days in a month) x Maximum working hours in a day)] x Total overtime hours

2. Hourly Wage Workers

In the case of hourly wage workers, gross salary (Basic Salary + DA + other allowances) is not considered while calculating overtime. Hence, the formula is:

OT = 2 x [Basic Salary / (Total number of working days in a month) x (Maximum working hours in a day)] x Total overtime hours

Note: Due to the Shops and Establishment Act (SEA), the actual overtime calculation formulas may slightly differ from region to region. However, the ones mentioned above are typically acceptable.

Example of Overtime Pay Calculation

Now, let’s put the above formula into practice. Here’s an example of how to calculate overtime salary:

Suppose an individual who earns ₹12 LPA has 4 overtime work hours booked in August 2024. Based on this statement, we can easily derive the following particulars:

- Basic Annual Salary = ₹12,00,000

- Dearness Allowance (DA) = ₹10,000 (as fixed by the company)

- Rent Allowance (RA) = ₹4,000 (as fixed by the company)

- Total number of working days in a month = 30

- Maximum working hours in a day = 8 hours

Now, you first need to determine the employee’s Monthly Basic Pay. In this case, the amount is ₹1,00,000 (Basic Annual Salary/12).

Since OT = 2 x [Basic Salary + DA + any other allowance / (Total number of working days in a month) x Maximum working hours in a day)] x Total overtime hours

Therefore, the employee’s overtime pay amount would be;

= 2 x [(1,00,000 + 10,000 + 4,000)/(30 x 8)] x 4

= 2 x [1,14,000/240] x 4

= 2 x 475 x 4

= ₹3,800

Pro tip: Alternatively, you can also use an online overtime calculator to determine the overtime pay amount for your employees without any manual effort!

What Are the Common Overtime Pay Calculation Mistakes and How Can You Avoid Them?

Now that you know all about overtime allowance calculation, here are a few common pitfalls you should be wary of and tips to avoid them:

Applying Incorrect Rate

In India, overtime wages must be paid at double the regular rate, as per legal requirements. However, many employers tend to overlook this rule. Therefore, to ensure compliance and accuracy, it’s essential to regularly review and update pay rates.

Ignoring Local Regulations

Every Indian state has its own set of overtime rules and regulations which employers may fail to take into account. To avoid this, consult with legal experts while calculating overtime and stay updated about local and state labor laws.

Miscalculating Work Hours

Sometimes, employers can miscalculate overtime work hours by missing to record clock-ins or accounting for unrecorded breaks. However, this can affect the overtime pay’s accuracy. To prevent this, employ a robust time-tracking solution.

Refusing Unauthorized Overtime Claims

Overtime pay is mandatory, whether or not an employee seeks prior authorization for the same. However, this can be confusing. So, to avoid this, establish clear procedures for overtime authorization and ensure that all overtime worked is properly documented

Wrapping Up

Overtime pay forms an essential component of an employee’s salary as it directly affects their motivation and dedication toward the organization. If an employee receives a fair overtime allowance, they are not just encouraged to walk that extra mile for the company—they also feel contented and valued.

Therefore, use the right overtime calculation formula to make sure you accurately calculate overtime pay for your employees.

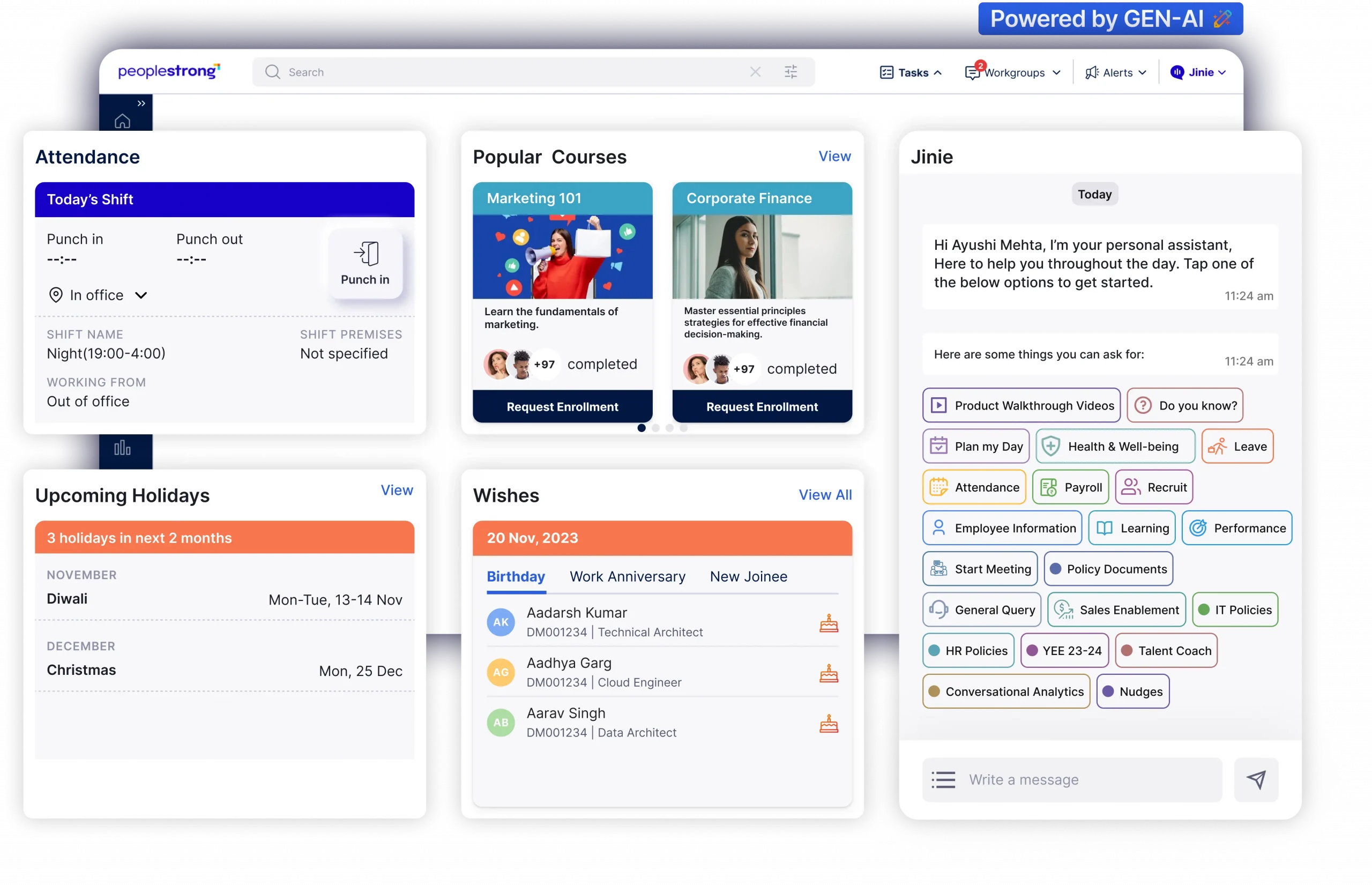

In this regard, you can check out PeopleStrong. An all-inclusive SaaS platform, PeopleStrong’s robust Payroll Software automates all aspects of payroll management for you—right from overtime pay calculation to taxes—to ensure it’s accurate, compliant, and efficient.

So, hurry up—get in touch today!

Some Common FAQs

How common is working overtime in India?

Working overtime is quite common in India. Statistically speaking, approximately 40% of office workers in the country have admitted to working overtime regularly.

What is the most common overtime rate?

The most common overtime rate in India is twice the regular hourly wage. Put simply, anyone who works beyond the standard 48 hours per week is entitled to double their regular pay for those extra work hours.

How to cut down overtime?

There are many ways a company can control overtime in their organization. For instance, delegate responsibilities, hire additional staff, automate repetitive tasks, etc.

What are legal working hours in India under the Factories Act or Shops & Establishments law?

In India, adult employees generally cannot be required to work more than 9 hours a day or 48 hours a week under the Factories Act or state Shops & Establishments Acts. Any hours beyond these limits are treated as overtime, often paid at double wage rate.

What are legal overtime limits per day/week in India?

Beyond the normal 9 hours/day or 48 hours/week, overtime is applicable. The spread-over and state Acts may limit overtime to a certain number of hours in a quarter. Often overtime rate is double. Employers must follow state specific limits under Shops & Establishments / S&E Acts.

Is overtime mandatory for all employees?

No. Some roles (executive, managerial, supervisory) may be exempt under law. Also companies can have policy-based exemptions. Be careful: “exempt” definitions vary by country/state.

What are the consequences of non-compliance with overtime and working hours laws?

Consequences include legal penalties or fines, required back payments, reputational damage, employee dissatisfaction, potential litigation. In India, state labour departments inspect compliance with Shops & Establishment / Factories laws.