The Union Budget 2020 presented a new tax regime for individual taxpayers. There are always 2 sides to the coin. However, the new tax regime offers lower tax rates, it requires the taxpayer to forego certain specified deductions and exemptions that one has been enjoying so far. To simplify the existing New Income-tax law, the finance minister of India has introduced a new income tax regime from 01 April 2020, wherein lower income tax rates will apply for those individual taxpayers who forgo certain deductions and exemptions. All tax exemptions are removed, except for the National Pension Scheme (NPS).

Revised Income Tax Rates

The new income tax rate for individuals with income between Rs 5 to 7.5 lacs is 10% (which was 20% earlier), income between Rs 7.5 to 10 lacs is 15% (reduced from the current tax rate 20%), income between Rs 10 to 12.5 lacs is 20% (which was 30% earlier) and income between Rs 12.5 to 15 lacs is 25% (down from the existing rate 30%). For those who have an income above Rs 15 lacs, the tax rate would be 30%.

Here is a piece of summarized information on the applicable tax slab under the existing and the new income tax regime and its effect on payroll processing.

| Income slabs (Rs) | Tax Rate (Old Regime) | Tax Rates |

| Up to 2.5 lacs | Nil | Nil |

| 2.5-5 lacs | 5% | 5% (Tax rebate of Rs 12,500 available under section 87A) |

| 5-7.5 lacs | 20% | 10% |

| 7.5-10 lacs | 20% | 15% |

| 10-12.5 lacs | 30% | 20% |

| 12.5-15 lacs | 30% | 25% |

| Above 15 lacs | 30% | 30% |

The tax so calculated will be subject to health and education cess of 4%

Comparison between the New Tax Regime and the Old Tax Regime

Pros of the New Tax Regime

Reduced Tax rates and reduced compliance: The new regime provides for lower tax rates vis-à-vis tax rates in the existing or old regime. You may ask Which deductions are allowed in new tax regime? Here is your answer, with more than 70 deductions and exemptions removed from the new tax regime except for NPS, tax filing is much easier with less documentation required.

The flexibility of Investment choices: As per the existing tax regime, the taxpayer needs to follow a standard set tax saving instruments and the manner as prescribed within the regime. This may be beneficial for a certain section of taxpayers who may wish not to opt for specified modes of investment, a majority of instruments have a longer lock-in period. A taxpayer may invest in open-ended instruments/funds/deposits, which gives higher returns with a higher flexibility of withdrawals or deposits and most importantly flexible lock-in period. For instance, certain eligible instruments have a longer lock-in period such as fixed deposits with banks, equity-linked savings schemes (ELSS) is for three years, National Savings Certificates (NSC) for five years, etc.

Higher In-Hand Income: The reduced interest rates for incomes ranging between 5 lacs to 15 lacs, allows the salaried class taxpayer with more in-hand income. This allows the freedom to the taxpayer to direct one’s funds accordingly and also benefits individuals who could not invest in specified instruments due to certain financial or other personal reasons.

Cons of the New Tax Regime

With effect from April 1, 2020, taxpayers have an option to choose between the new and old tax regime system. The transition to a new tax regime would devoid the taxpayer from the following exemptions: –

Deductions for various payments/investments covered under chapter VIA of Income Tax such as life insurance premium, Mediclaim premium, principal repayment of housing loan, tuition fees, etc.

Exemptions such as House Rent Allowance (HRA), Leave Travel Allowance (LTA), and deductions such as standard deduction, profession tax, Tax Exemption on vouchers for food.

In case of self-occupied house property, no deduction for interest paid on housing loans will be available under Housing loan interest (Section 24B).

Making the choice

Given the details about the New Tax Regime, the taxpayers have to decide what is best for them. The New Tax Regime offers the flexibility of investment choices and more in-hand income. Whereas the Old Tax Regime offers concessions and deductions. Since the Government gives you one-time option to choose between the New Tax Regime and the Old Tax Regime, it is highly advisable to do a comparative analysis under both Tax Regimes, before opting for one.

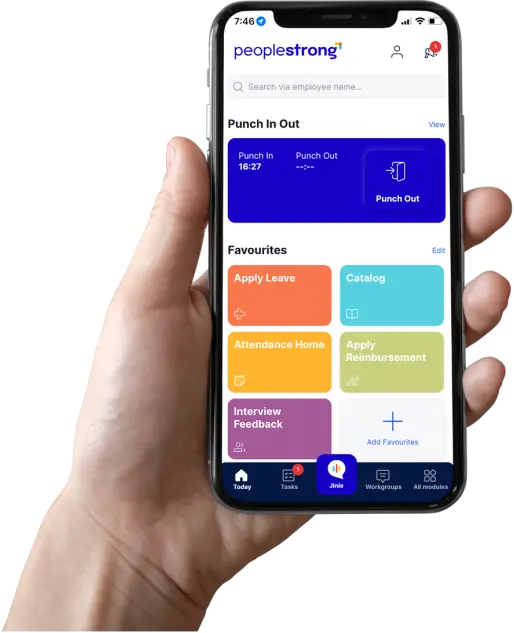

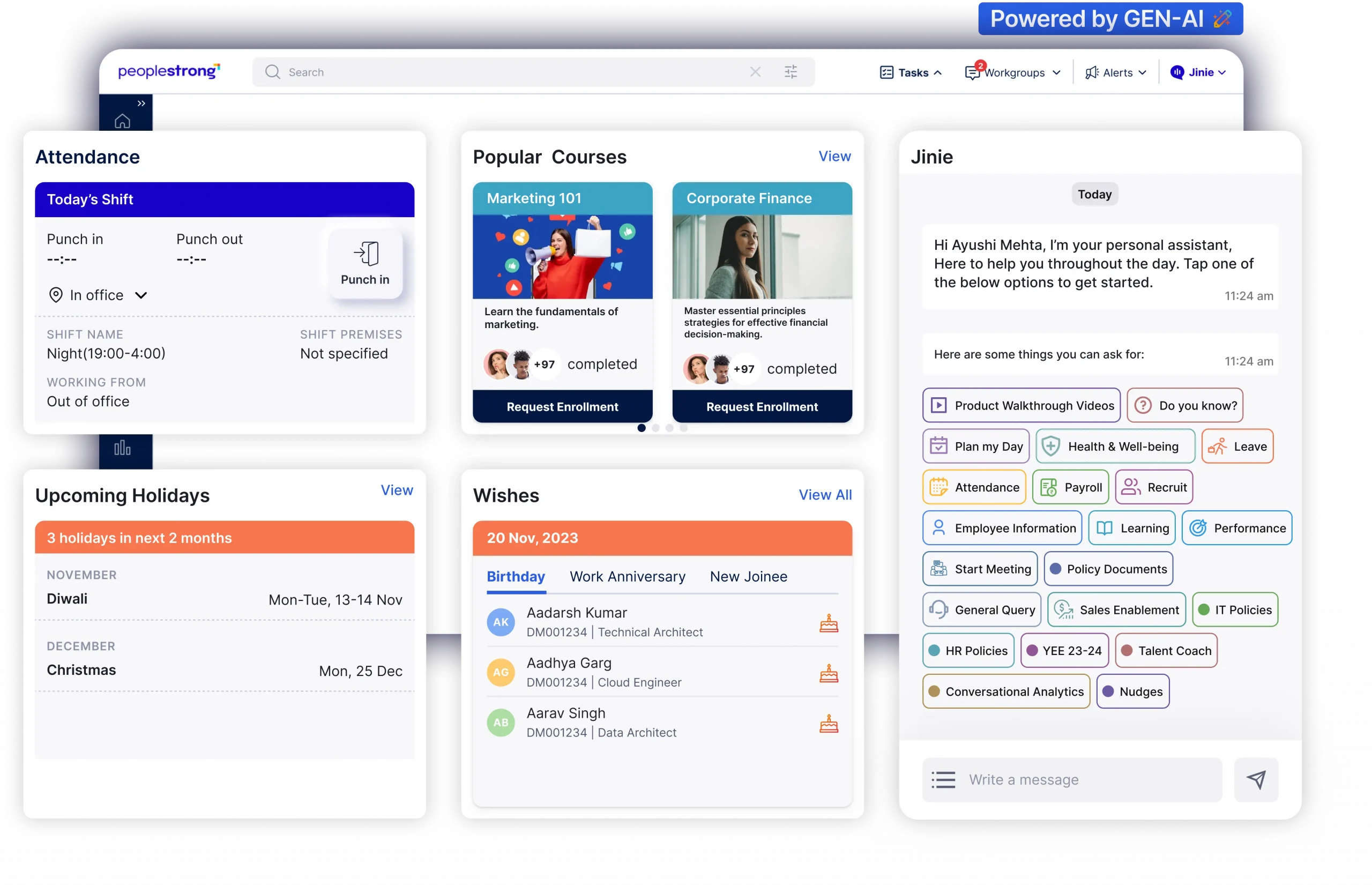

Payroll and HR are at the core of every organization. With a new-age workforce distributed across geographies, organizations are grappling with multiple online payroll processes, numerous pay-components, and inconsistent payroll software.

PeopleStrong’s Payroll Outsourcing Software provides an intelligent payroll management system for building smarter workplaces. Get in touch with our payroll and compliance executive to know more about Payroll Software and how we can manage your payroll better.

In these turbulent times, as organizations are struggling with Remote payroll environment and facing challenges with On-Time & Accurate salaries, reimbursements, appraisals, and bonuses. We at PeopleStrong are offering a 3 Month Free Trial for Online payroll management tool to help organizations manage their payroll more efficiently and effectively.