Employee offboarding can be as complex and time-consuming as onboarding, involving several formalities and steps. Managing it efficiently can be challenging, which is why our Employee Exit Policy Sample is designed to simplify the process.

An employee exit policy outlines the rules and procedures for an employee’s formal departure from the company, whether due to resignation, retirement, or termination. It covers important aspects like notice periods, final settlements, and other key details to ensure a smooth and legally compliant transition.

This Employee Exit Policy Will Help You to:

- Understand the rules and regulations pertaining to exit policy in India

- Standardize the entire employee exit policy in your company

- Stay compliant while terminating an employee

- Minimize the chances of errors and omissions during employee offboarding

Employee Exit Policy Template

Here’s a breakdown of the fundamental aspects of the template:

1. Objective

This document aims to standardize the guidelines and process for formal employee exit at <Name of the Company> based on its business and client requirements.

2. Exit Management System

This policy highlights the process to be followed at <Name of the Company> while employee offboarding and is applicable across all the company’s offices in India.

3. Policy Salient Features

- An exiting employee must serve the notice period as outlined in their offer letter. Early release is at the discretion of the reporting manager and HR head.

- Remaining leave cannot offset the notice period.

- Employees with remaining leave are entitled to encash up to 30 privilege leaves during the full & final settlement; any leave beyond 30 will lapse.

- Employees with no remaining leave during the notice period will have the requested leave deducted from the final settlement.

- Flexible Benefit Plan (FBP) will not be considered in the final gross salary calculation. The final amount will be gross minus FBP.

- If the Last Working Day (LWD) is on or before the 15th of the month, the salary for the previous month and the 15th will be withheld.

- All pending tasks and knowledge transfer must be completed before the employee exits, and the L1 Manager/Function Head must sign off on this in writing.

- Full & final settlement will be completed within 60 days of submitting company assets with a signed General Release Letter (GRL).

- Conferred benefits like mobile phones, laptops, and cars must be returned before the last working day.

- Training bonds, personal loans, or bill payments made on behalf of the employee will be adjusted in the final settlement.

- The signed GRL must be submitted to HR on the last working day for the settlement process to proceed.

4. Procedure for Resignation

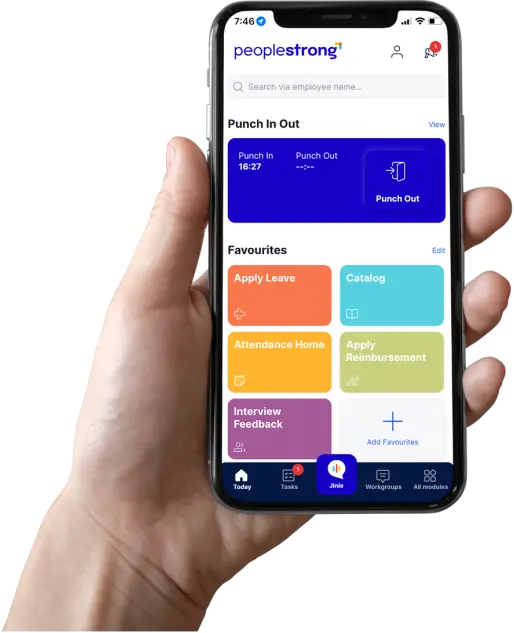

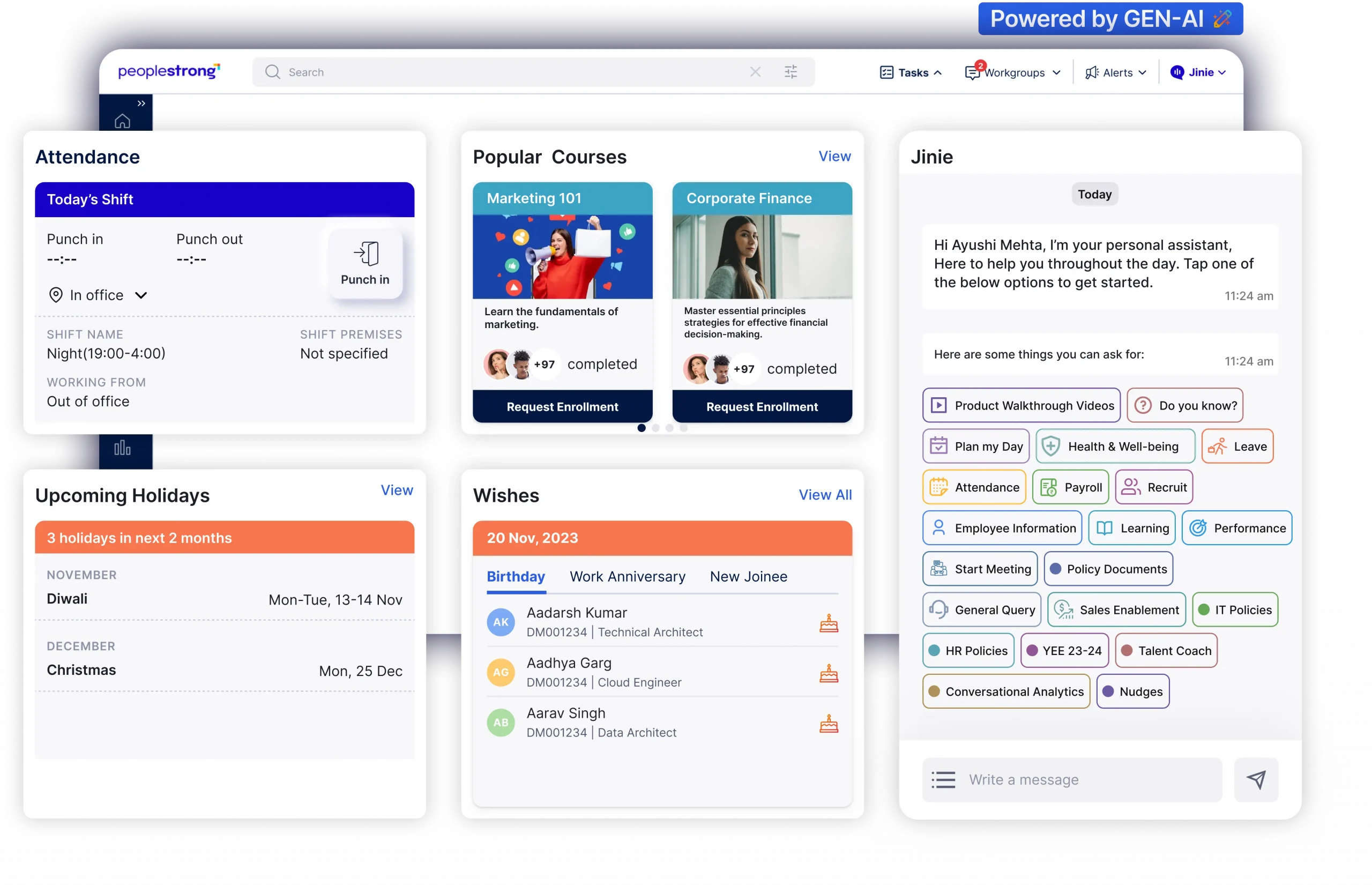

- To resign from <Name of the Company>, an employee must follow these steps on the HRMS portal:

- Login to HRMS.

- Select the “Exit” tab.

- Provide “Correspondence Information” and “Relieving Information.”

- Click “Submit.”

- For trainees/consultants, the resignation notice must be submitted as per the notice period in the offer letter, and the last notice day will be considered the contract end date.

- The exiting employee must inform their L1 Manager and HR about serving the full notice period or discuss any deviations.

- Once the L1 Manager accepts the resignation, the employee will receive a confirmation email on their official ID.

- After the full & final settlement, HR will issue an experience-relieving letter within 60 days of the last working day.

5. Adjustment of Leave Against Notice Period

The notice period is the time an exiting employee uses to transfer duties and complete tasks before leaving the company. Therefore, the employee is expected to work throughout the notice period.

- <Name of the Company> may adjust unserved notice period days during final settlement if early release is approved.

- Only the Chief People Officer (CPO) can approve notice period waive-offs, not L1/L2 Managers.

- Approval for notice period waiver must come from the Practice Head/Function Head and AVP-HR or higher.

- No compensation for incomplete notice period fulfillment.

- Employees may opt for a notice period buyout to reduce the number of days required to serve.

- The buyout amount will be calculated based on the employee’s daily salary.

- The rate charged will be [employee’s monthly basic salary]/30 x remaining notice days].

- Approval for a notice period buyout must be obtained from the Chief People Officer (CPO) and the Practice Head/Function Head.

6. Exit Process

Exit policy steps for an exiting employee at <Name of the Company> on their last working day:

- Submit the General Release & Waiver Letter (GRL).

- Obtain No Dues Clearance (NDC) from the L1 Manager via HRMS.

- Return company assets to IT or opt for paid pick-up (cost <enter amount>, deducted from the final payment).

- Submit and get investment proofs approved on the HRMS before the Last Working Day (LWD).

7. Absconding Process

If an employee fails to show up without informing their L1 Manager, the manager will first attempt to reach out. If unreachable, they will email HR about the employee’s absconding following 7 days of continued absence.

The absconding process at <Name of the Company>:

- HR contacts the absent employee using company contact details. If no response, HR sends an Absconding Letter & Email 1 to the employee’s official email.

- If there is still no response, HR sends an Absconding Letter & Email 2 after 3 days. If there’s no reply, HR will initiate the exit process on the HRMS portal, with the last active day as the exit date.

- HR will copy the L1 Manager on all communications with the employee.

- The absconding employee must return company assets to IT or opt for paid pick-up (cost <enter amount>, deducted from Full & Final Settlement).

- The employee will receive their full and final settlement and experience letter within 60 days of submitting company assets.

- No compensation will be given if the absconding employee doesn’t complete their notice period.

- If recovery is indicated, the employee must pay <Name of the Company> before receiving their relieving letter.

- Legal action will be taken if the absconding employee fails to comply with these rules.

8. Notice Period

- Only resignation dates submitted via HRMS will be considered.

- All employees must complete their specified notice period in full.

- HR/HRMS will determine the last working day in consultation with the manager.

- Exiting employees must transfer all responsibilities and knowledge to a designated team member, confirmed in writing by their L1 Manager.

- Balance Privilege Leave(s) cannot be adjusted against the notice period.

- If required, employees may take casual/sick leave

- Taking leave during the notice period will extend the employee’s last working day. For each leave, 2 days shall be added to the notice period.

- Employees leaving without completing their notice period must compensate for business losses and training costs, and their Gross Salary will be adjusted for the notice period shortfall.

9. Exit Formalities

- The HR team will conduct an exit interview with the exiting employee.

- The exiting employee must complete a General Relieving Letter and an Exit Questionnaire, which should be scanned and sent to HR.

- The exiting employee must fulfill all clearance requirements from IT, Finance, and Admin.

- Once clearances are submitted via HRMS, the exiting employee must return all company assets to their respective departments and their ID card to HR.

- The Full & Final Settlement will be completed within 60 days of the required clearances and submissions.

- The exiting employee’s last month’s salary will be included in the Full & Final Settlement.

10. Demise Process

This table highlights the process to be followed at <Name of the Company> if any of its employees pass away while in service. It ensures the case is handled with due sensitivity and professionalism while addressing every task quickly and respectfully.

| S. No. | Tasks | Responsibility | TAT |

| 1 | Inform the HR Manager of the loss | L1 Manager | |

| 2 | Punch exit as deceased in the HRMS portal | HR Manager | |

| 3 | Initiate NCD | HR | 1 working day |

| 4 | No dues clearance | All NDC SPOCs | 2 working days |

| 5 | Follow-up with support function and NDC SPOCs | HR | |

| 6 | Full & Final Settlement | Finance | 15 days |

| 8 | Update the EPFO department regarding the employee’s demise for the claim | HR | 7 days |

10. 1 Online Death Claim Process and Document Requirements

This section outlines the requirements for beneficiaries/nominees of a deceased employee filing an online death claim on the PF portal:

- The nominee must update the deceased employee’s E-nomination details on the PF portal.

- Required documents for online death claim processing:

- Official death certificate of the deceased employee.

- Bank account proof (canceled check or photocopy of passbook).

- Nominee’s birth certificate.

- Aadhar-linked mobile number of the nominee.

- Upload all documents in PDF format, each not exceeding 2 MB.

- Avoid spaces in file names.

Note: The employer must also inform the GTL partner.

11. Full & Final Settlement

- The HRMS will determine the resignation date.

- The Full & Final Settlement will be completed within 60 days of the last working day, pending all NDCs.

- The exiting employee must obtain clearance from all stakeholders on their last working day.

- Investment proofs must be submitted by the LWD to the Finance Team.

- Reimbursement bills must be submitted at least a week before LWD with HRMS approval.

- Salary during the notice period will be included in the Full & Final Settlement; if LWD is on or before the 15th, the previous month’s salary will be withheld and paid along with it.

- For a 30-day notice period, salary will be paid with the Full & Final Settlement.

- If resignation is pending L1 approval, salary will be withheld regardless of notice served.

- Experience letters will be issued after the Full & Final Settlement.

- In case of recovery, the exiting employee must issue a check/NEFT in the company’s name.

12. Retirement Clause

A retirement clause is a guideline that governs the age at which an individual is eligible for retirement, along with any associated benefits/obligations. These dates are subject to change depending on the jurisdiction, industry, and the parties involved in the agreement.

Retirement Age: The retirement age at <Name of the Company> is 58 years.