Beyond the Paycheck: A Strategic Guide to Choosing the Right Automated Payroll Software

Choosing the right automated payroll software is crucial for business efficiency and compliance. This guide helps you navigate features, scalability, integration, and support to make an informed decision. Selecting the

Payroll Automation ROI: Unveiling the Business Benefits

The Burning Question: Is Payroll Automation Worth the Hype? In today’s fast-paced business environment, the quest for efficiency and accuracy is relentless. One area where companies often seek improvement is

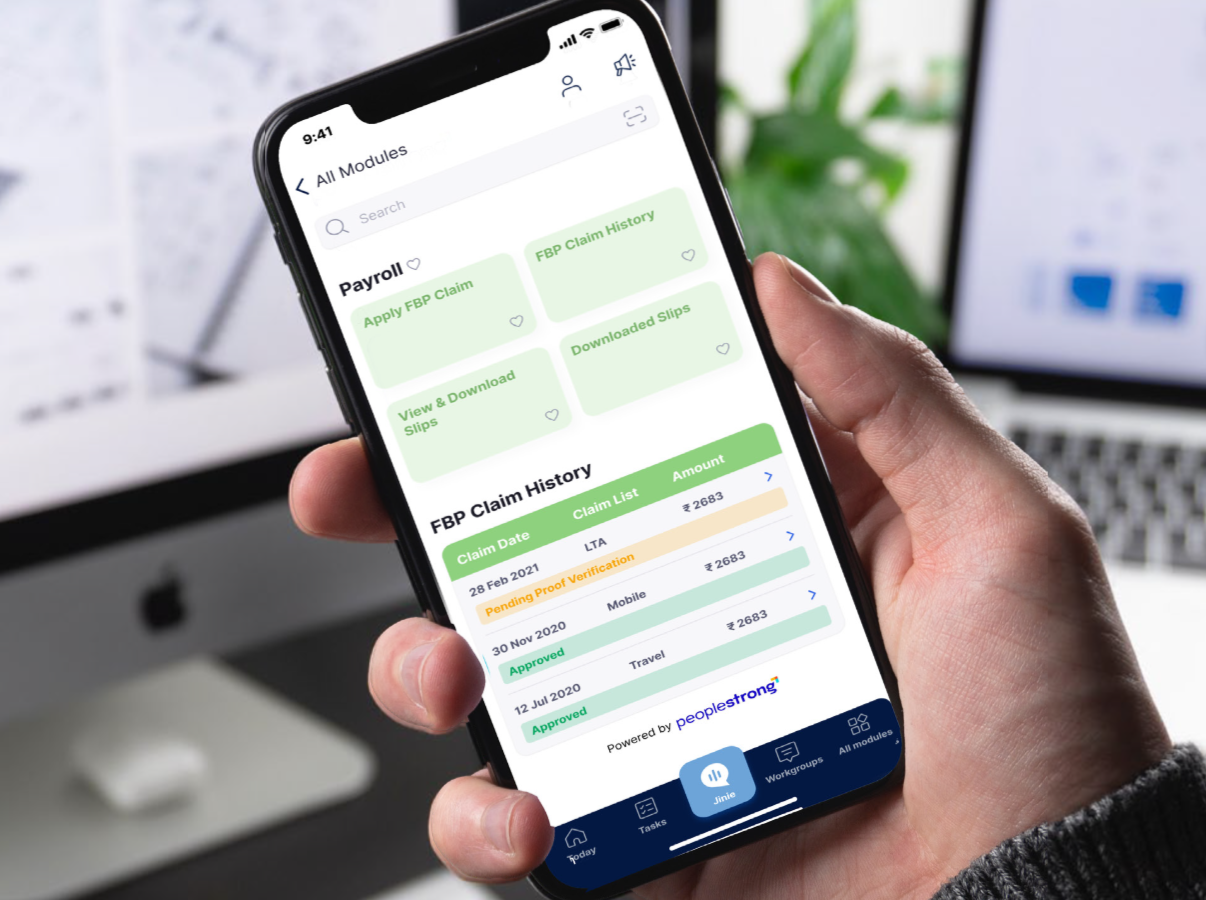

Making Salary Slips Simple: How AI is Changing Employee Experience.

If there’s one thing employees consistently struggle with, it’s understanding their salary slips. For most employees, the salary slip is a complex document filled with line items—basic, HRA, allowances, deductions,9 Best Payroll Outsourcing Companies in India [2025]

Does managing your company’s payroll feel like a constant juggle between complex regulations, strict deadlines, and the fear of costly errors? Well, you are not alone, as constant changes to

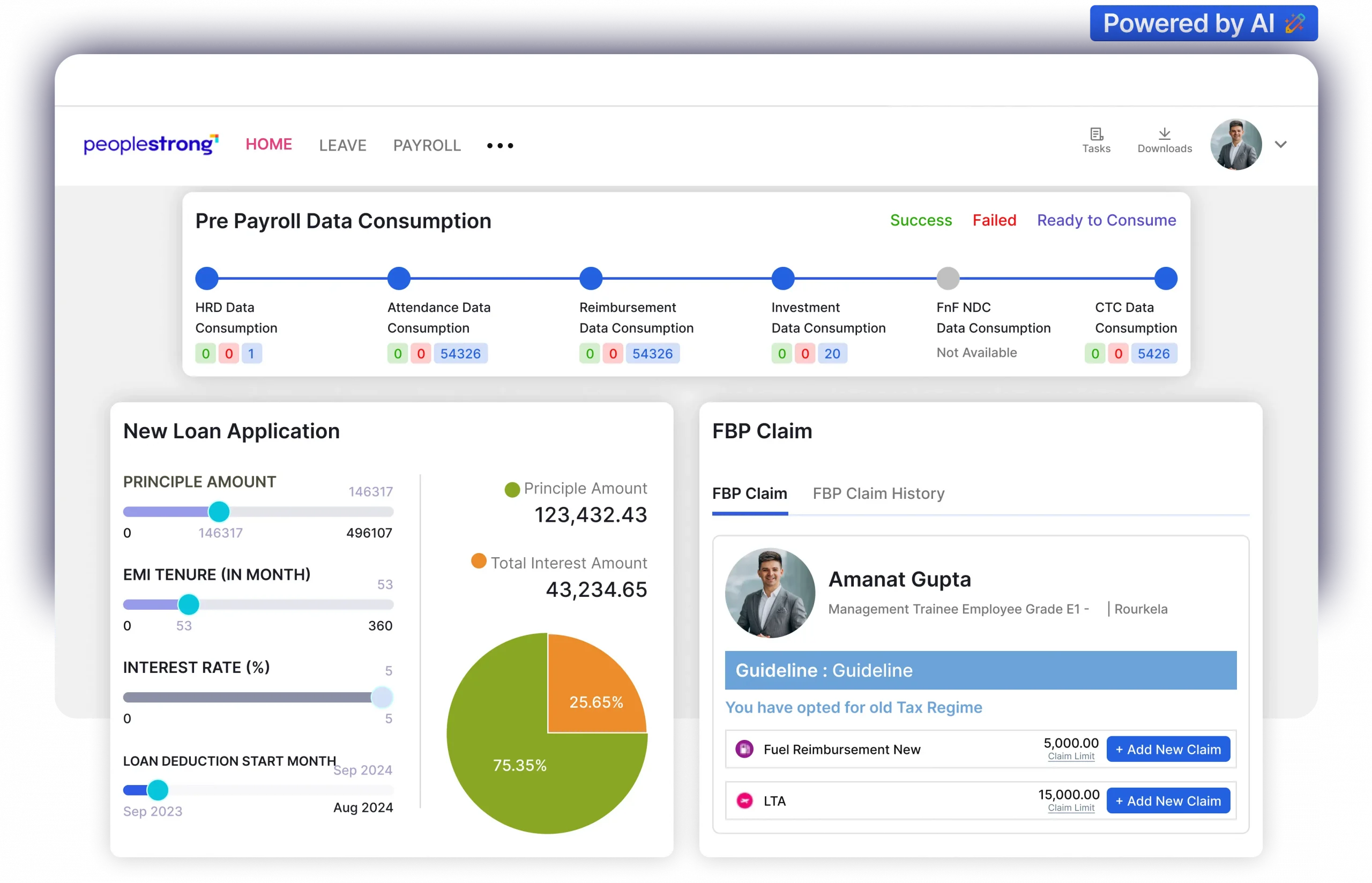

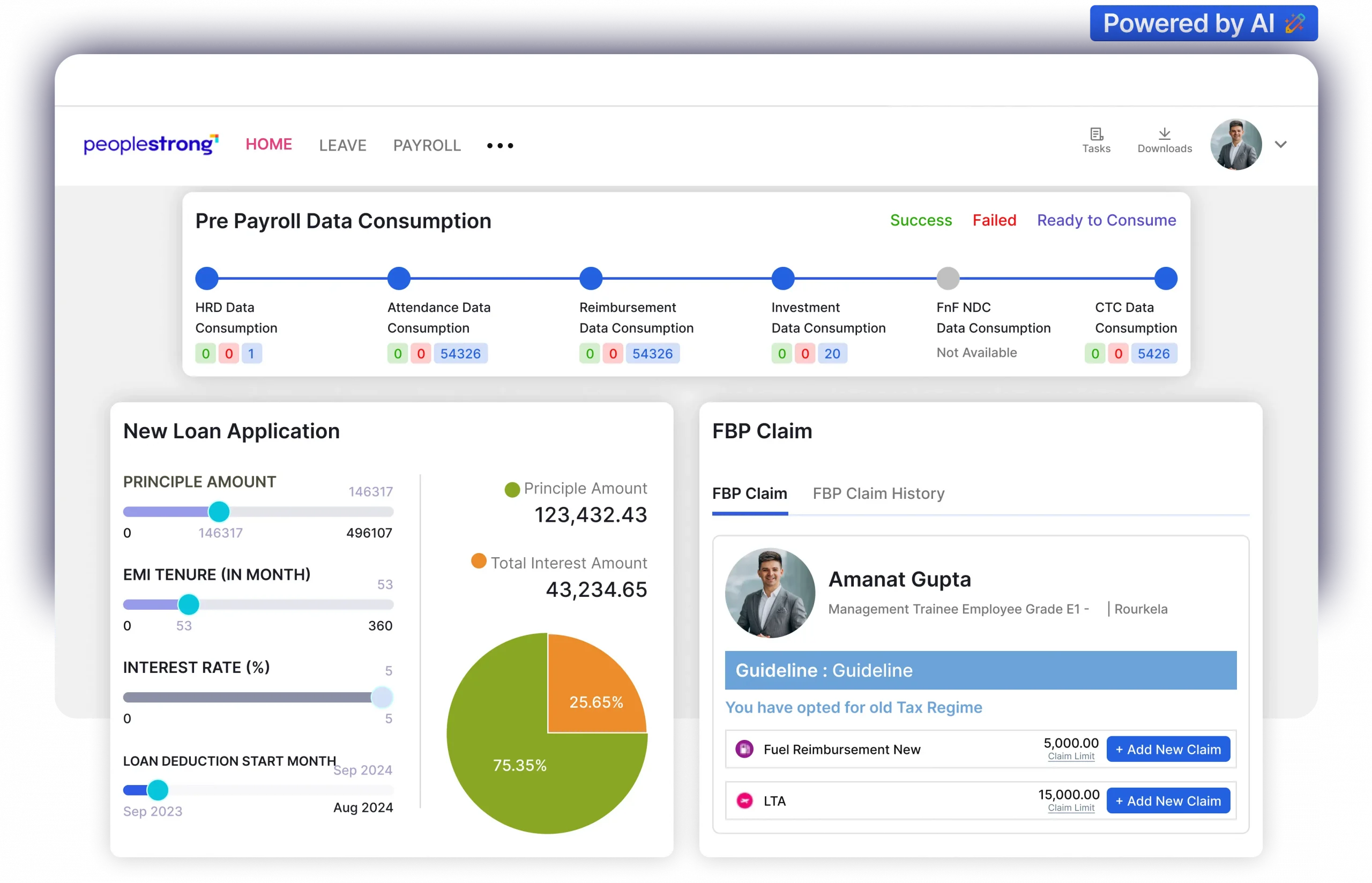

11 Best Payroll Software in India: 2025 Guide

Payroll management in 2025 has evolved into a strategic function. It’s no longer just about processing salaries; it’s now a critical blend of compliance, automation, and employee experience. With the

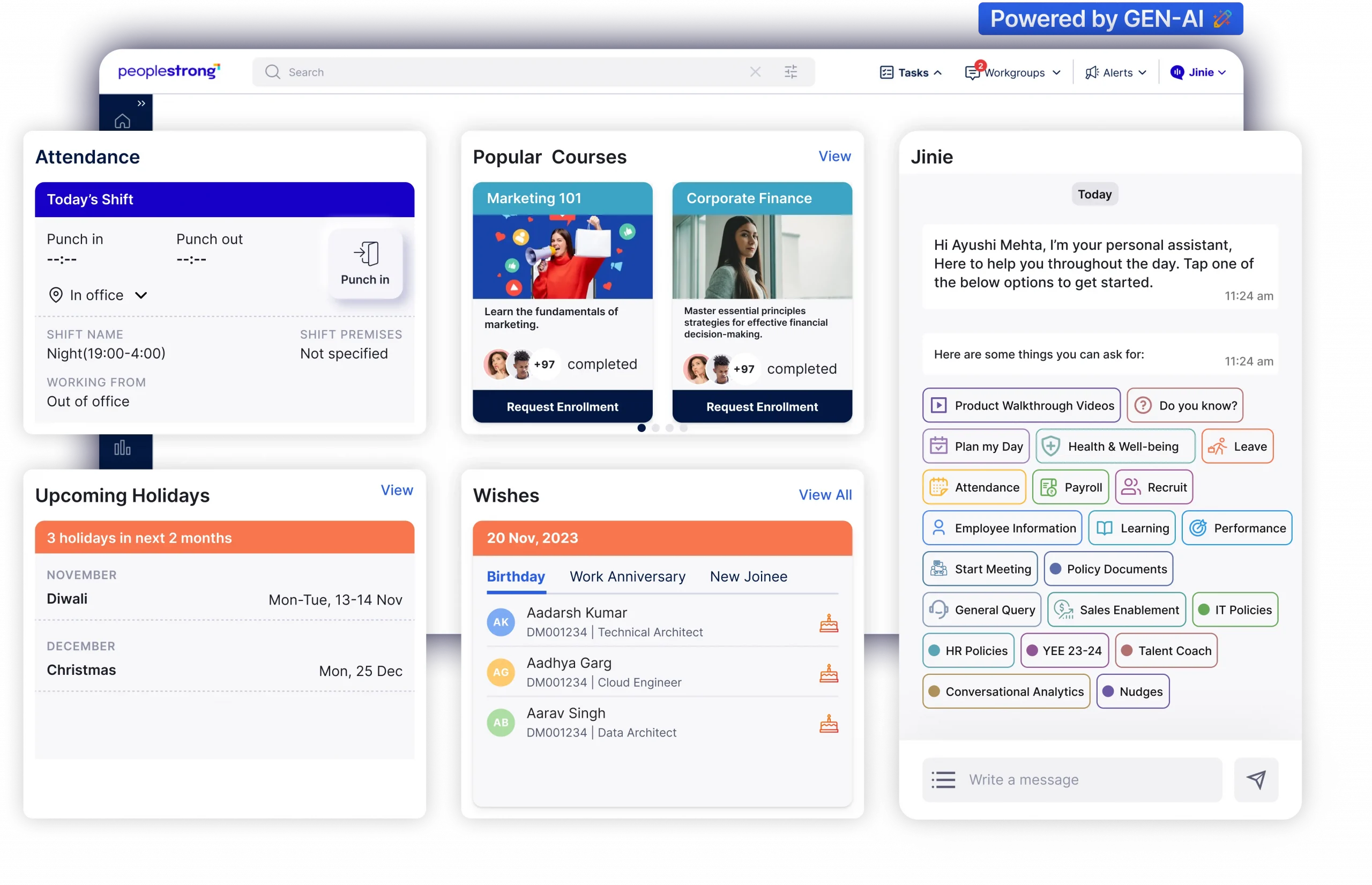

9 Best Workforce Management Software in India

Every seasoned HR professional knows that the recipe for organizational success is efficient workforce management. It ensures teams are aligned, well-managed, and, most importantly, engaged, as they tend to be

Strategic Workforce Planning: A Complete Guide to Future-Proofing Your Business

Workforce planning helps businesses prepare for future talent needs while keeping operations efficient. It ensures the right people are in place to support long-term goals. Being proactive and deliberate about

Guide to Leave Encashment: Calculation, Taxation, Rules & Exemptions

Did you know: The limit for tax exemption on leave encashment was raised from Rs. 3 lakh to Rs. 25 lakh by the Finance Ministry in 2023? Employees have different

Navigating Overtime Pay in India: A Comprehensive Guide

In India, working overtime is a common corporate practice. Employees across different industries frequently devote additional hours at work. A recent International Labour Organization survey found that the average Indian