Payroll Management is the process of calculating and disbursing employee salaries, taxes, and other benefits.

It is an essential aspect of any enterprise. For a business, effectively payroll management means

- Better employee morale and productivity

- Compliance with local labour laws

- Better budgeting, planning, and decision-making

However, despite its importance, many enterprises still make mistakes in payroll management.

These mistakes can result in legal issues, financial losses, and employee dissatisfaction.

In this blog post, we will discuss the common mistakes that enterprises make when it comes to payroll management.

Not having a payroll management system in place

“According to the 2021 Payroll Complexity Index, 40% of Enterprises still use spreadsheets, and 18% continue to use high-risk and largely non-compliant manual and paper-based activities as part of their payroll processing.”

For SMBs, the lack of a payroll system can lead to errors in calculating employee salaries, taxes, and benefits. It can also result in delays in disbursing salaries, which can lead to employee dissatisfaction.

Manual payroll processing can expose sensitive payroll data to unauthorized access, misuse or theft.

In several jurisdictions, mistakes/delays in payroll can result in legal penalties and fines not to mention the countless grievances between employees and employers that can simply be done away with.

Not keeping up with local tax regulations

Tax regulations are constantly changing, and enterprises need to keep up with these changes to avoid legal issues. This is more so in a post-COVID environment where countries have been enacting local laws such as GDPR (Europe), Data Privacy Act (Philippines), and Personal Data Protection Law (Indonesia).

Depending on your circumstances, proper tax planning could also lead to a significant reduction in taxes paid, which means more money goes into your core business.

While for SMBs it may not be feasible to have dedicated teams across the globe, opting for a payroll service provider with a proven history of managing changing local tax regulations may be the most practical choice on the table.

Not maintaining proper employee records

The tale of FTX is a stark reminder of how employee records are poorly maintained by several organizations across the globe.

Misclassification of employees and not maintaining proper records in a central repository can lead to legal issues and financial losses. Maintaining accurate records isn’t just about compliance though. Smart employers recognize that rather than it being an administrative burden, ensuring records are well-maintained can offer hidden opportunities if leveraged rightly.

For instance, workplace records make everything from recruitment, right through to employee training and development and even offboarding easier and less stressful.

Not accurately tracking employee hours

Accurately tracking employee hours is crucial for calculating salaries and benefits. However, many enterprises still rely on manual processes for tracking employee hours, which can lead to errors.

Overtime pay is also a legal requirement across jurisdictions, and failure to comply with overtime regulations can result in legal issues and financial losses.

To avoid these, enterprises should invest in a time and attendance system that can accurately track employee hours and seamlessly integrate with your existing payroll system.

Not properly handling deductions

Employee deductions such as social security, and 401(k) contributions are crucial for accurate payroll calculations. However, many enterprises still fail to properly handle deductions.

Here is where the role of a payroll management system comes into play. The right payroll system can accurately calculate and disburse employee deductions and comply with relevant laws and regulations.

Not properly handling garnishments

Garnishments are legal orders that require employers to withhold a portion of an employee’s wages to pay off debts or other obligations. Failure to properly handle garnishments can result in legal troubles.

Enterprises should ensure that their payroll system can accurately handle garnishments to avoid unwanted complications.

Not properly handling terminations

Terminating an employee involves various payroll-related tasks such as calculating final pay checks, distributing benefits, and handling taxes. Failure to properly handle terminations can result in legal issues and employee dissatisfaction. Furthermore, a bad offboarding experience can adversely impact employee morale.

Thus, it becomes crucial for enterprises to ensure that their payroll system can smoothly handle terminations and comply with relevant laws and regulations while doing so.

Conclusion

Given the changing technological landscape and demands of employees, payroll is set to change in the coming few years.

An advanced payroll system is necessary for any organization that plans to invest in employee experience and productivity.

However, besides focusing on the technology aspect, the usability and flexibility of the platform need to be considered.

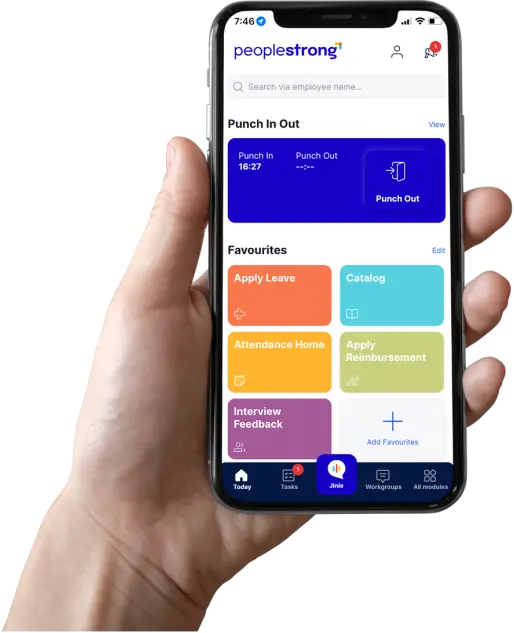

PeopleStrong’s local legal expertise will guide you through complicated labour and tax requirements so you can run payroll without hassle.

PeopleStrong’s next generation payroll management platform will also equip your organization with seamless and efficient payroll processing while improving employee satisfaction through intuitive employee self-service options and customizable features.

The robust platform will help you create a smarter workplace through intelligent payroll management. If you are looking to upgrade your payroll process or grappling with building enhanced transparency around a distributed workforce and operations, PeopleStrong Payroll could be the solution you’re looking for.

Find out more about PeopleStrong’s next-generation Payroll