The Union Budget 2023-24, presented by Finance Minister Nirmala Sitharaman on February 1, included some major announcements with respect to Personal Income Tax. These changes are to benefit the hard-working salaried middle class of the country who accounted for nearly 50% of IT Returns filed in 2022.

Salaried individuals were expecting major tax reliefs since they have been grappling with the multi-layered impact of layoffs, pay cuts, and rising inflation.

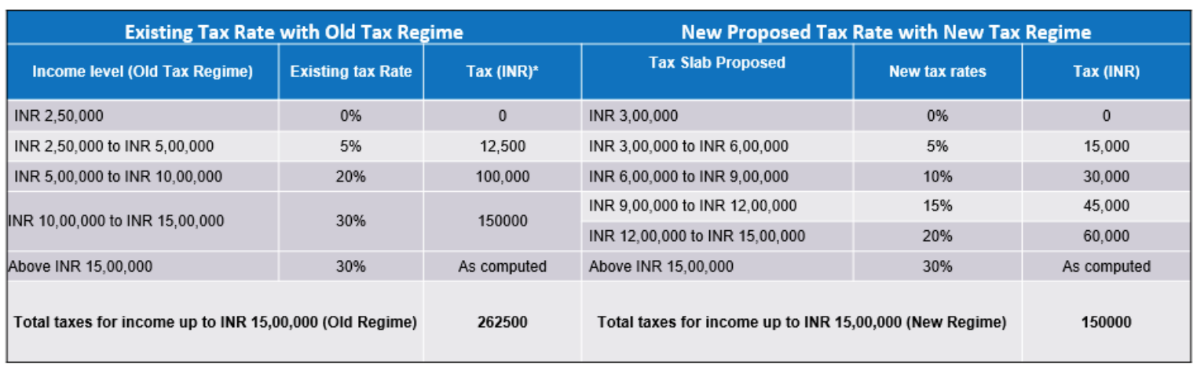

- The 2023 Budget has proposed that taxpayers with income up to ₹7 lakh now do not need to pay any income tax under the new tax regimes. Earlier, the previous income tax rebate limit was ₹5 lakh. The tax exemption limit has also been increased from ₹2.5 lakh to ₹3 lakh.

- The simplification of tax slabs from six to five, as well as making the New Tax Regime the default regime would be appreciated by citizens.

An illustrative analysis of tax rates under the new tax regime vis-à-vis the old regime

Currently, around 1% opt for the New Tax Regime and we estimate that there would be a big shift to the New Tax Regime in the next F.Y. We have studied our payroll data and based on that we would like to share the following:

Employees getting an annual salary between ₹5 to ₹7 lakh, get 2.73% of total gross as HRA exemption and invest 8.15% of total gross under Chap VIA. If they shift to the New Tax Regime, they will save an average of ₹30,000 in annual tax. This trend is the same for employees getting up to ₹18 lakh as annual salary. We predict that they would move to New Tax Regime in the next Financial Year.

Employees earning upward of ₹18 lakh up to ₹5 crore may continue with the Old Tax Regime.

Employees earning more than ₹5 crore would shift to the New Tax Regime as the benefits they get under Chap VIA and rent exemption is around 2% of total gross and since the surcharge has been reduced from 37% to 25%, they would get more benefits under the New Tax Regime.

These measures are pegged to give a great boost to the country’s middle class, which includes a rapidly growing gig economy, especially in light of current global macroeconomic factors and the hint at an upcoming recession of uncertain duration. The effect of the changes in the tax slabs under the new regime, combined with the extension of standard deduction benefits provides a good amount of tax savings to salaried taxpayers.

Based on insights from processing over 800,000 paychecks in India just this month on the PeopleStrong Payroll Platform and observing a significant percentage of employees earning under the ₹18LPA bracket, our experts at PeopleStrong believe that more than 80% will make the shift to the New Tax Regime. The changes proposed in the Union Budget 2023 incentivize this shift for a large number of salaried taxpayers who definitely stand to gain more.

For 100% Accurate, Compliant and Automated Payroll, that makes payroll processing easier and your employees happier, get in touch!